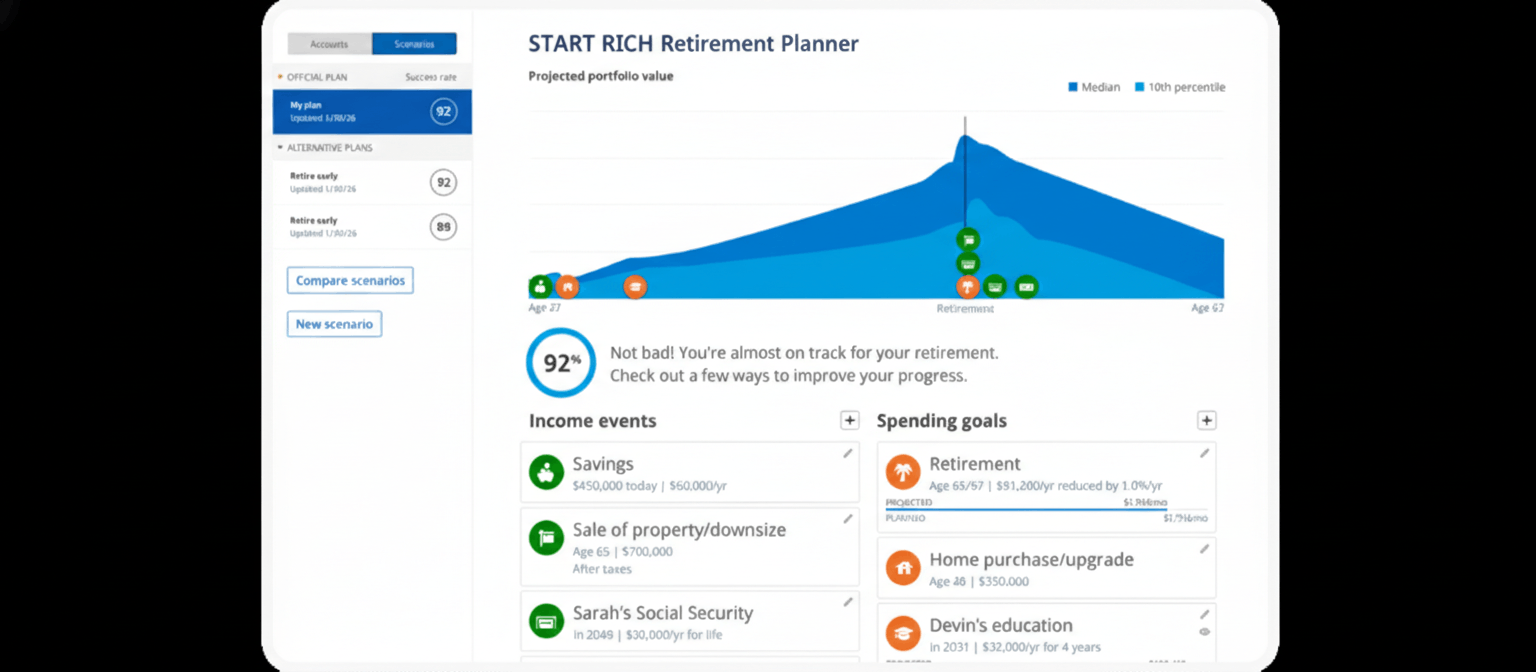

Plan ahead to retire your way

Beyond a calculator, test-drive what retirement could look like.

Plan when I can retireTake Control of Your Retirement Future

Answer the most important questions: When can you retire? How much do you need? What lifestyle can you afford? Get personalized insights based on your unique situation.

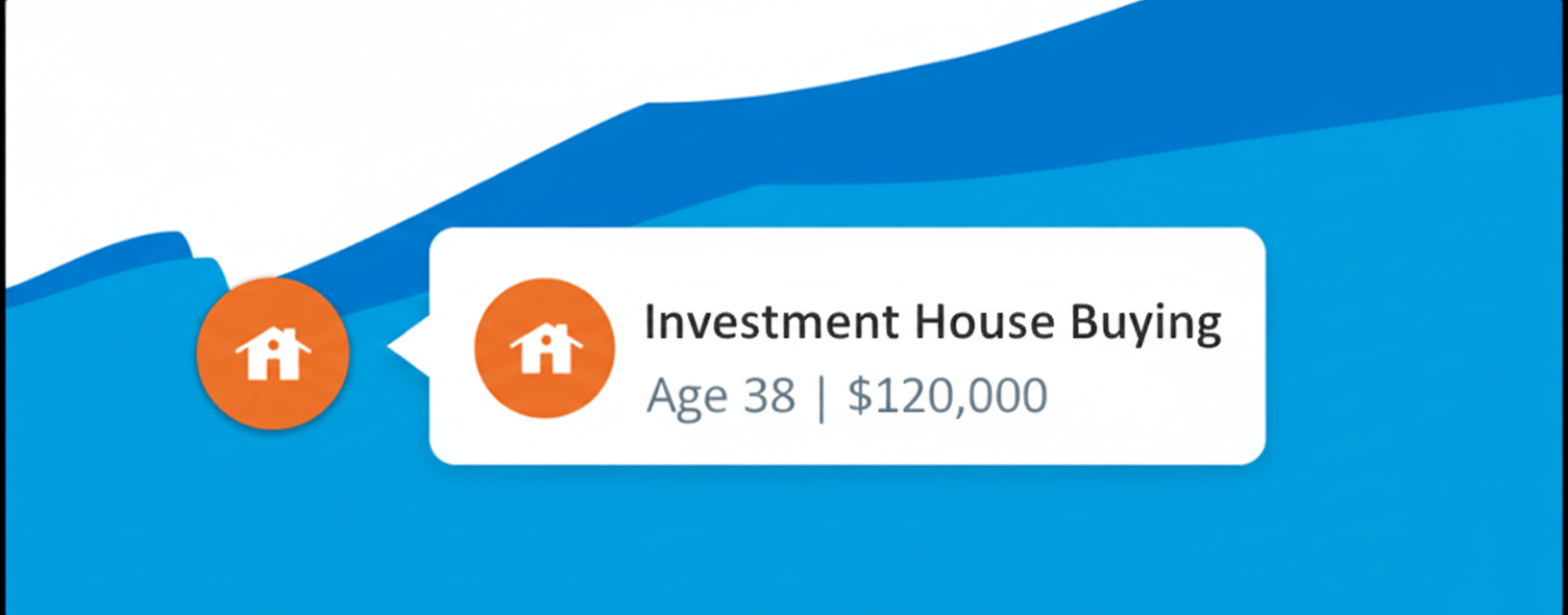

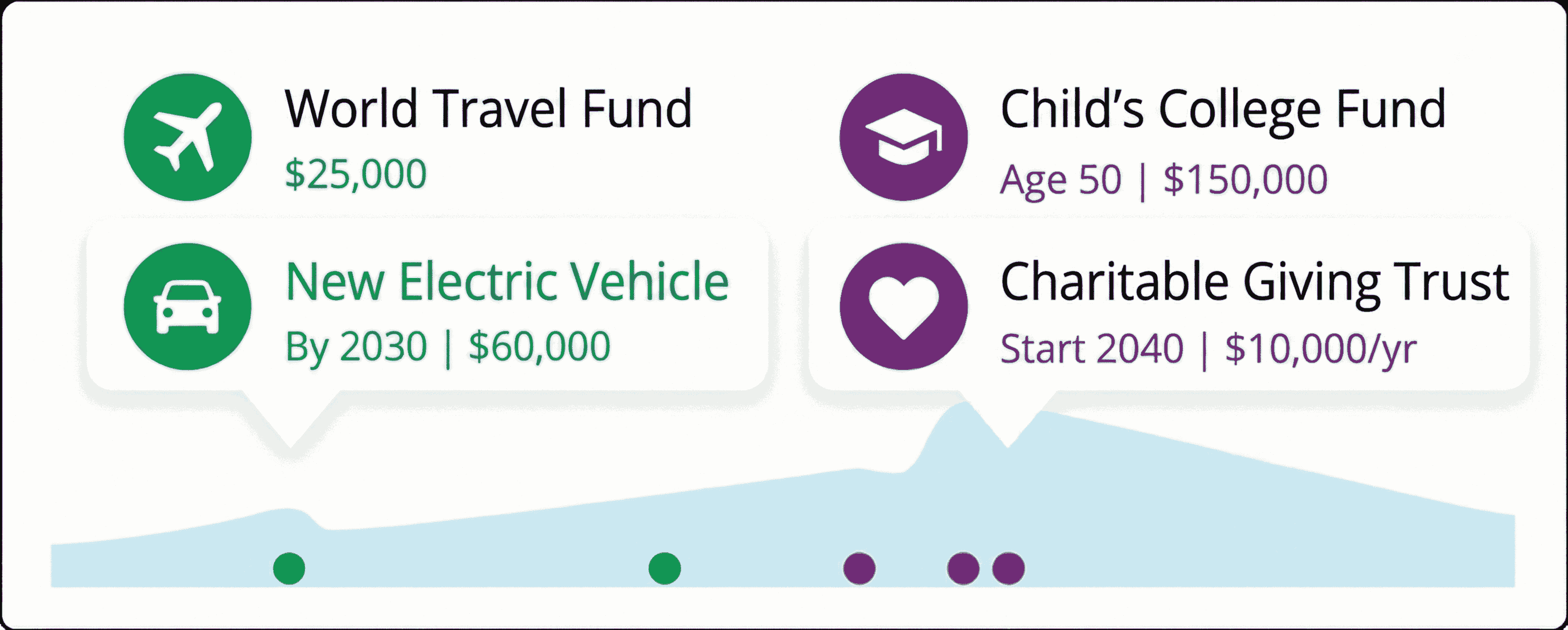

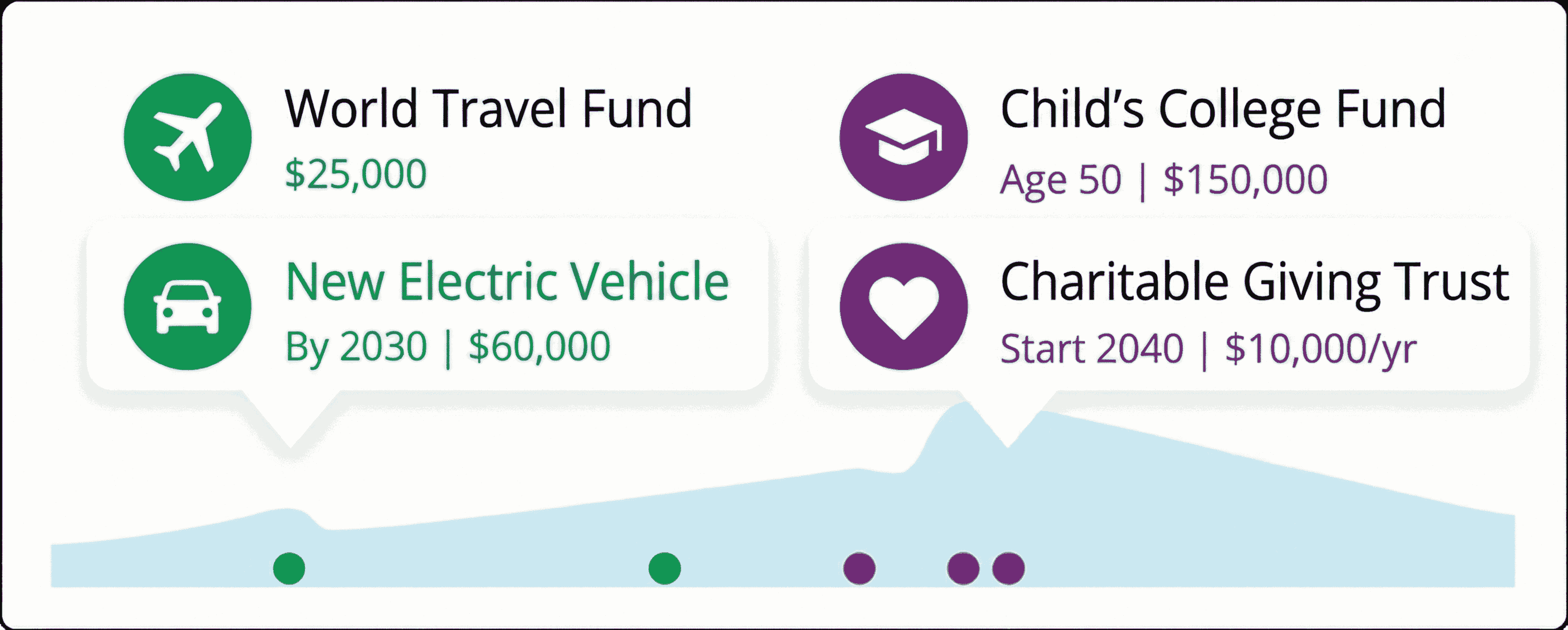

Plan Your Retirement Lifestyle

Define your retirement spending—from daily living expenses to travel, hobbies, and healthcare. See if your savings can support the retirement you envision.

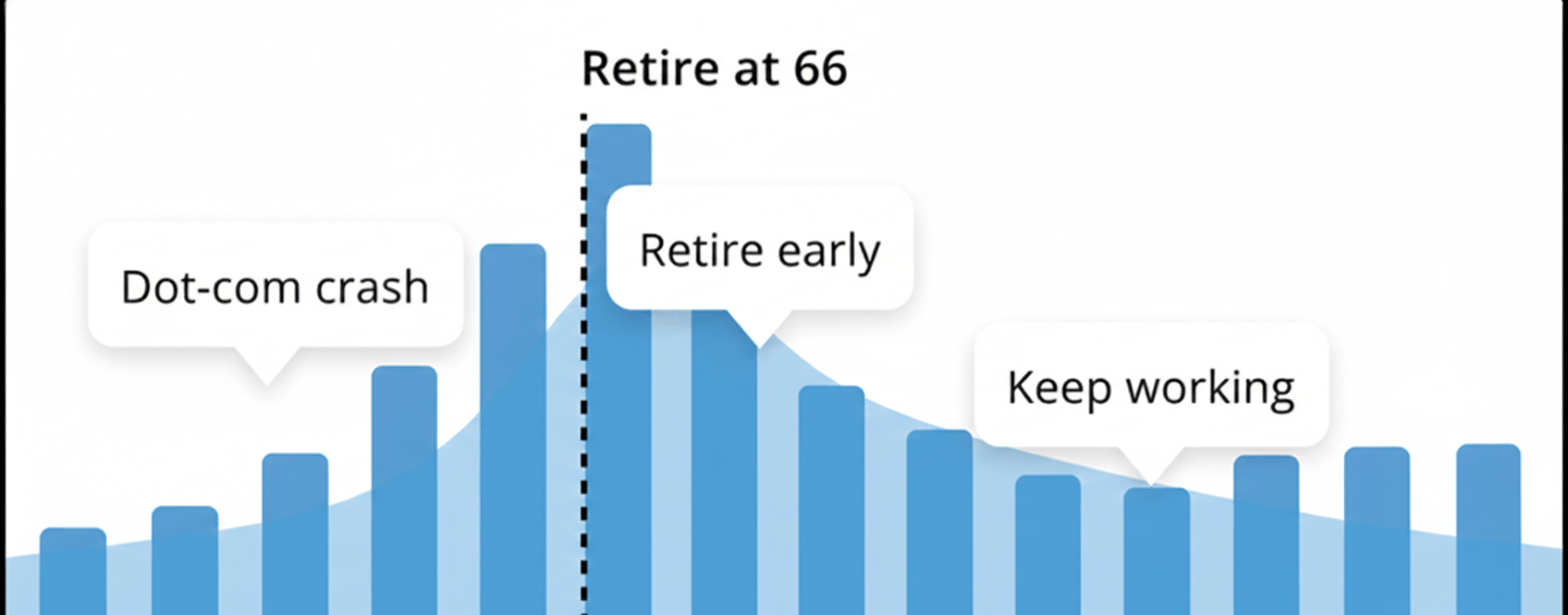

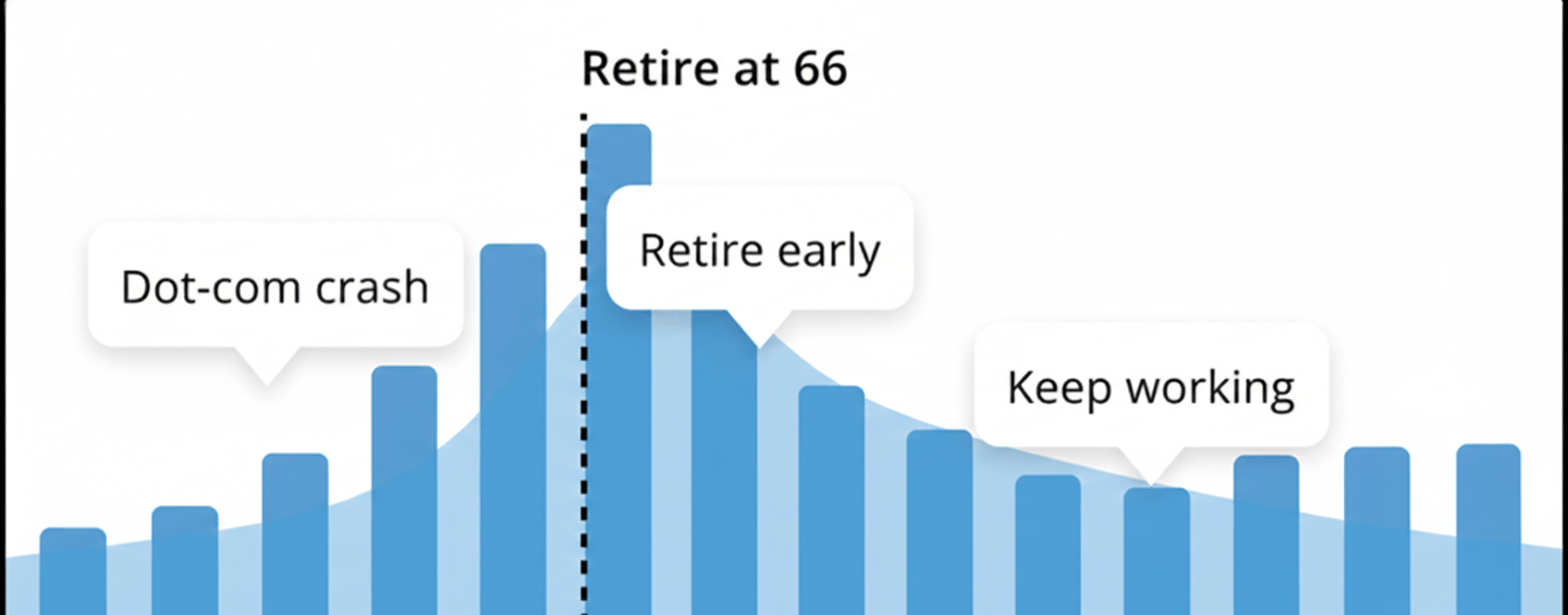

Find Your Retirement Date

Explore retiring at 55, 60, 65, or beyond. Compare how different retirement ages impact your nest egg, Social Security benefits, and financial longevity.

Manage Retirement Withdrawals

Create a smart withdrawal strategy from your 401(k), IRA, and other accounts. Balance your spending needs while making your retirement savings last.

Account for Real-World Factors

Factor in inflation, healthcare costs, investment returns, and market downturns. Stress-test your retirement plan against different economic scenarios.

Plan Your Retirement Lifestyle

Define your retirement spending—from daily living expenses to travel, hobbies, and healthcare. See if your savings can support the retirement you envision.

Find Your Retirement Date

Explore retiring at 55, 60, 65, or beyond. Compare how different retirement ages impact your nest egg, Social Security benefits, and financial longevity.

Manage Retirement Withdrawals

Create a smart withdrawal strategy from your 401(k), IRA, and other accounts. Balance your spending needs while making your retirement savings last.

Account for Real-World Factors

Factor in inflation, healthcare costs, investment returns, and market downturns. Stress-test your retirement plan against different economic scenarios.

“This tool gave me the confidence to finally set a retirement date. Seeing different scenarios side-by-side helped me understand exactly what I needed to save and when I could realistically retire.”

Frequently Asked Questions

A retirement planner is a financial tool that helps you estimate how much money you'll need to retire comfortably. Our calculator uses proven methodologies including the Trinity Study for safe withdrawal rates, Monte Carlo simulations with 10,000 scenarios to model market volatility, and FIRE (Financial Independence Retire Early) calculations to project your retirement readiness based on your current savings, income, and expected expenses.

The Safe Withdrawal Rate is the percentage of your retirement savings you can withdraw annually without running out of money. Our calculator uses CAPE (Cyclically Adjusted Price-to-Earnings) ratio adjustments based on the Trinity Study. For 2026, with elevated market valuations (CAPE > 25), we recommend a 3.0-3.5% withdrawal rate. This is more conservative than the traditional 4% rule to account for current market conditions and ensure your retirement funds last.

Monte Carlo simulation runs 10,000 different market scenarios to estimate your retirement success probability. It models real-world market volatility using historical parameters: 7% average stock returns with 18% volatility, and 2% bond returns with 6% volatility. This provides a more realistic assessment than simple linear projections, showing you the range of possible outcomes and your probability of retirement success.

FIRE (Financial Independence Retire Early) numbers represent the total savings needed to retire. We calculate three types: Standard FIRE (Annual Expenses × 25, based on 4% withdrawal rate), Conservative FIRE (Annual Expenses × 33, based on 3% withdrawal rate for current market conditions), and Coast FIRE (the amount needed today that will grow to your FI number by retirement age, assuming no additional contributions).

For 2026, the S&P 500 is recommended as the core retirement investment with ~10-15% expected annual returns and moderate risk. Professional forecasts from Goldman Sachs, Barclays, and UBS support this outlook. Bitcoin can be a satellite holding (5-15% allocation) for aggressive investors due to extreme volatility (30-100%+ swings possible). Bitcoin's wide forecast dispersion ($60k-$225k for 2026) makes it unsuitable as a primary retirement asset. A balanced approach: 60-80% S&P 500, 5-15% Bitcoin, remainder in bonds/cash.

The amount needed depends on your desired retirement lifestyle and expenses. A general guideline: multiply your expected annual retirement expenses by 25-33. For example, if you need $50,000/year, you'll need $1.25-1.65 million saved. Use our calculator to input your specific situation including current age, retirement age, current savings ($100k average), annual income ($100k average), contribution rate, and expected returns to get a personalized projection.

For 2026 retirement planning, use 7% real return (after inflation) for stocks and 2% for bonds. The S&P 500 has historically returned 10-11% nominal (7-8% real). Current professional forecasts suggest 10-15% returns for 2026 due to AI-driven earnings growth and potential Fed rate cuts. However, conservative planning should account for market downturns: use 6-7% for balanced portfolios and run Monte Carlo simulations to test various scenarios.

The Trinity Study (1998) analyzed historical retirement withdrawal rates from 1926-1995 to determine sustainable withdrawal strategies. It found that a 4% initial withdrawal rate adjusted for inflation provided a 95% success rate over 30-year retirements with a 50/50 stock/bond portfolio. Our calculator enhances this with CAPE-adjusted rates: when market valuations are high (CAPE > 25, like in 2026), we recommend more conservative 3-3.5% rates to maintain retirement security.

Inflation erodes purchasing power over time. Our calculator accounts for this by using 'real returns' (returns after inflation). For example, if stocks return 10% nominal and inflation is 3%, the real return is 7%. For 2026, the Federal Reserve targets 2% inflation. Long-term retirement planning should assume 2-3% annual inflation, meaning your retirement expenses will roughly double every 24-36 years. This is why we project year-by-year scenarios adjusted for inflation.

Yes, our Retirement Planner by Start Rich is completely free to use. There are no hidden fees, subscriptions, or premium tiers. You get full access to all features including retirement projections, Monte Carlo simulations, safe withdrawal rate calculations, FIRE number computations, and interactive visualizations. The tool is designed to democratize access to sophisticated retirement planning methodologies typically available only through paid financial advisors.

Ready to plan your retirement?

Start exploring different retirement scenarios and see what's possible for your future.

Start Planning Now